kizuna-biz.ru

News

What Is Call Put Option

Options are simply a legally binding agreement to buy and/or sell a particular asset at a particular price (strike price), on or before a specified date . Know what's the difference between Call option and Put option. A call option is a contract that gives the option buyer the right to buy an underlying asset at a specified price within a specific time period. On the contrary, a put option is the right to sell the underlying stock at a predetermined price until a fixed expiry date. While a call option buyer has the. A put and call option agreement is a contract between a company and shareholder that determines the terms relating to purchasing and selling stock. Know what's the difference between Call option and Put option. Options are simply a legally binding agreement to buy and/or sell a particular asset at a particular price (strike price), on or before a specified date . The essential difference between call option and put option arises from the fact that one is an option to buy an underlying asset and the other an option to. An option contract gives the owner the right, but not the obligation, to buy or sell an underlying asset for a specific price within a specific time frame. Options are simply a legally binding agreement to buy and/or sell a particular asset at a particular price (strike price), on or before a specified date . Know what's the difference between Call option and Put option. A call option is a contract that gives the option buyer the right to buy an underlying asset at a specified price within a specific time period. On the contrary, a put option is the right to sell the underlying stock at a predetermined price until a fixed expiry date. While a call option buyer has the. A put and call option agreement is a contract between a company and shareholder that determines the terms relating to purchasing and selling stock. Know what's the difference between Call option and Put option. Options are simply a legally binding agreement to buy and/or sell a particular asset at a particular price (strike price), on or before a specified date . The essential difference between call option and put option arises from the fact that one is an option to buy an underlying asset and the other an option to. An option contract gives the owner the right, but not the obligation, to buy or sell an underlying asset for a specific price within a specific time frame.

What is call and put option with example? · An option is the right to buy or sell a security at a particular price within a specified time frame. · A call. A put option - on the other hand, is the right to sell the underlying share at a predetermined price until a specified expiry date. A call option purchaser has. A put option gives an option holder the authority to sell an underlying security or stock at a certain price and within a specific time frame. After paying a. Call options give buying rights, while put options offer selling rights. Call option buyers expect price increases, and put option buyers. An option is a derivative contract that gives the holder the right, but not the obligation, to buy or sell an asset by a certain date at a specified price. Aspiring Financial Analyst | Graduate student in · Call Option: Call option holders have the right but not the obligation to buy the underlying. The focus going forward in this module will be on moneyness of an option, premiums, option pricing, option Greeks, and strike selection. Options are simply a legally binding agreement to buy and/or sell a particular asset at a particular price (strike price), on or before a specified date . An option is a financial derivative on an underlying asset and represents the right to buy or sell the asset at a fixed price at a fixed time. Call options trading is a contract which provides rights to purchase a particular stock at a predetermined price and expiry date. Call options are commonly employed by investors anticipating a rise in the underlying asset's price, offering them the opportunity to buy the asset at a. A call option is used when we expect the stock prices to increase while a put option is used when the stock prices are expected to depreciate. When you buy an option, you pay for the right to exercise it, but you have no obligation to do so. When you sell an option, it's the opposite—you collect. WHAT IS A PUT OPTION? A put option is a derivative contract that lets the owner sell shares of a particular underlying asset at a predetermined price . The answer to these questions can be found in the concept of put call parity and options arbitrage. The pricing relationship that exists between put and call. You buy a call at a strike price of $ for $ And you buy a put at a strike price of $ for $ To break even, the price needs to rise to $1, Put options give holders of the option the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a. Call options give buying rights, while put options offer selling rights. Call option buyers expect price increases, and put option buyers. A put option gives the buyer the right (but not the obligation) to sell shares of the underlying (usually a stock or ETF) at the strike price, on or before.

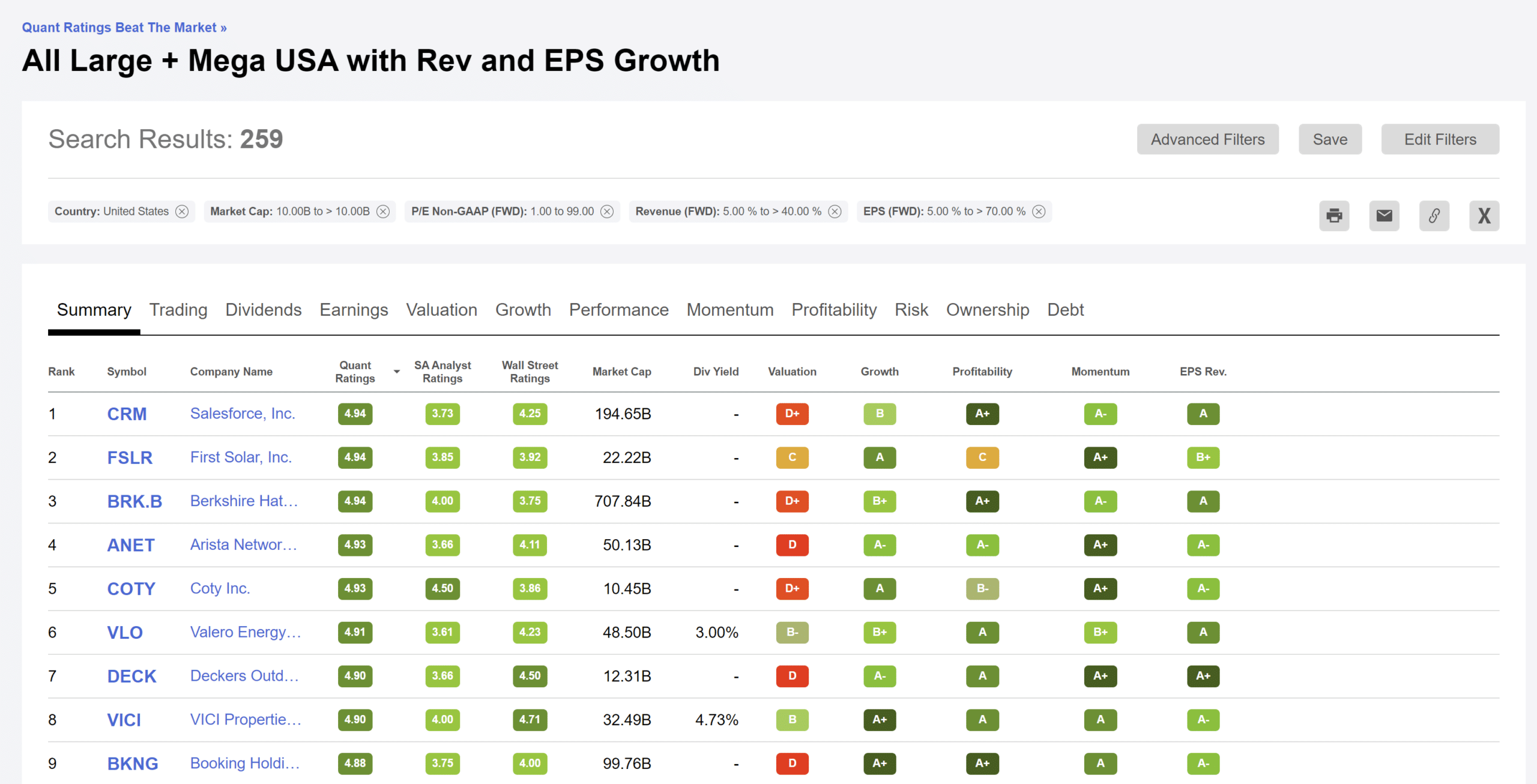

High Alpha Stocks Screener

High Alpha Low Beta stocks · 1. HCL Technologies, , , , , , , , , , , · 2. SKF India. GAP UP, GAP DOWN Technical & Fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap. HIGH ALPHA ANS LOW BETA STOCKS · 1. Sanofi India, , , , , , , , , , , , · 2. Coal. If you are a value investor who usually use fundamental metrics to scan for stocks, kizuna-biz.ru is best option undoubtedly. While their core product is. Low beta High Alpha ; Akzo Nobel, ; Sanofi India, ; C P C L, ; Glenmark Life, This list contains stocks with the highest profitability score. It is important to know that high/low profitability has nothing to do with stock's. High Alpha Low Beta. Get Email Updates. Company growth. by Jenil. 40 Stock analysis and screening tool. Mittal Analytics Private Ltd © Low beta high alpha · 1. Sanofi India, , , , , , , , , , , · 2. Coal India, , Alpha Stocks · 1. Radhika Jeweltec, , , , , , , , , , , , · 2. Z F Steering, High Alpha Low Beta stocks · 1. HCL Technologies, , , , , , , , , , , · 2. SKF India. GAP UP, GAP DOWN Technical & Fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap. HIGH ALPHA ANS LOW BETA STOCKS · 1. Sanofi India, , , , , , , , , , , , · 2. Coal. If you are a value investor who usually use fundamental metrics to scan for stocks, kizuna-biz.ru is best option undoubtedly. While their core product is. Low beta High Alpha ; Akzo Nobel, ; Sanofi India, ; C P C L, ; Glenmark Life, This list contains stocks with the highest profitability score. It is important to know that high/low profitability has nothing to do with stock's. High Alpha Low Beta. Get Email Updates. Company growth. by Jenil. 40 Stock analysis and screening tool. Mittal Analytics Private Ltd © Low beta high alpha · 1. Sanofi India, , , , , , , , , , , · 2. Coal India, , Alpha Stocks · 1. Radhika Jeweltec, , , , , , , , , , , , · 2. Z F Steering,

High Alpha Stocks ; 1. Elecon kizuna-biz.ru, ; 2. Action kizuna-biz.ru ; 3. Apar Inds. ; 4. Mazagon Dock, Seeking Alpha's Top Rated Stocks is a collection of the best-rated stocks from three independent sources available on the Seeking Alpha website. Please note that some tools (such at the stock screener) are no longer available because of regulatory and/or commercial burdens. We are sorry for the. Large cap stocks with the highest institutional buying as a percentage of its outstanding shares. Company. Last Price. A stock screener is a digital filter for the stock market, helping investors sort through thousands of stocks by applying various financial and qualitative. ETFs that fall under the Morningstar Global Large Stock and Foreign Asset Class based categories. The universe of preferred stocks used in this screener. Discover the power of a quantitative stock screener - Make Confident, High Return investment decisions. alpha“ back in , I must admit I was sceptic. High Alpha Low Beta. Get Email Updates. Sales > AND Return on equity Stock analysis and screening tool. Mittal Analytics Private Ltd © Selected Screeners: Index: Nifty Alpha 50 ; 1. Apar Industries Ltd · 8, %. 34, ; 2. Bajaj Auto Ltd · 10, %. 2,76, ; 3. Dixon Technologies . Take advantage of our custom screener that scans the markets for all the Trading Alpha indicator setups. Stop looking through 's of charts just trying to. Stock ratings screener ranks by Quant, Author or Sell-side rating. Create your own screener or use Seeking Alpha's preset screeners. With AlphaScreener, you can use fundamental and technical filters to filter more than 6,+ US stocks. You can then backtest your strategy with over 20 years. Expert Stock Screeners · This Stock Screener · View old version. High Alpha High Beta Stocks. Alert. Backtests. High Alpha High Beta Stocks. Query. The Stock Screener enables you to search for stocks and ETFs satisfying a specific set of conditions, using hundreds of variables. Select a variable in the list. When a stock performs above expectations, as determined by its beta and benchmark, it generates positive alpha. Conversely, stocks that lag the market generate. Nifty 50 Top Alpha Stocks ; 2. Adani Green, ; 3. Adani Enterp. ; 4. Rail Vikas, ; 5. Suzlon Energy, Free stock screener for investors and traders. Use customizable AInvest screener to find stocks and winning strategies to fit your trading style. Quality Low Beta stocks. High quality, low on volatility with high passive returns. Industry. + Screener. Company Name. Market Cap (Rs Cr). Beta 3M. Beta 1Y. High Alpha Low Beta ; 1. Sun TV Network, ; 2. Siyaram Silk, ; 3. Redington, ; 4. O N G C, This screener query contains Relative returns vs Nifty50 quarter%, Relative returns vs Nifty50 month%, Beta 3Year, Relative returns vs Nifty50 three years%.

How Much Will 1 Gallon Of Paint Cover

Divide the paintable wall area by (the square-foot coverage in each gallon can) to find the number of gallons of paint you need for the walls. You can round. If your paints Coverage Rate is square feet per gallon, then you'll require one gallon. If your paints Coverage Rate is square feet per gallon, you. Like paint, a gallon can cover to square feet. You can use the same result from the calculator to determine how many gallons you need per coat of primer. One gallon of paint will cover about square feet. Next, remember most painting projects will require at least two coats of paint to ensure quality. Paint per Square Foot. The general rule of thumb is a single 1-gallon can of paint can safely cover up to square feet with a single coat of paint. Paint Calculator. Before you or your contractor buy paint, find out exactly how much you'll need. If more than one room is being painted with the same color. A one-gallon can of paint will cover up to square feet, enough to cover a small bathroom. Two-gallon cans of paint covers up to square feet, enough to. Check the paint container to determine the estimated coverage. Generally, a quart of paint covers about square feet, and a gallon of paint covers square. In general, one gallon of paint or primer will cover roughly square feet of surface. Save time and money with the KILZ paint calculator to estimate. Divide the paintable wall area by (the square-foot coverage in each gallon can) to find the number of gallons of paint you need for the walls. You can round. If your paints Coverage Rate is square feet per gallon, then you'll require one gallon. If your paints Coverage Rate is square feet per gallon, you. Like paint, a gallon can cover to square feet. You can use the same result from the calculator to determine how many gallons you need per coat of primer. One gallon of paint will cover about square feet. Next, remember most painting projects will require at least two coats of paint to ensure quality. Paint per Square Foot. The general rule of thumb is a single 1-gallon can of paint can safely cover up to square feet with a single coat of paint. Paint Calculator. Before you or your contractor buy paint, find out exactly how much you'll need. If more than one room is being painted with the same color. A one-gallon can of paint will cover up to square feet, enough to cover a small bathroom. Two-gallon cans of paint covers up to square feet, enough to. Check the paint container to determine the estimated coverage. Generally, a quart of paint covers about square feet, and a gallon of paint covers square. In general, one gallon of paint or primer will cover roughly square feet of surface. Save time and money with the KILZ paint calculator to estimate.

The general rule of thumb, however, is that 1 gallon of latex paint will cover to sq ft. How much paint do you need for a 12x12 room? Most likely. One gallon of Interior BEHR ULTRA® SCUFF DEFENSE™ Paint and Primer, or BEHR PREMIUM PLUS® is enough to cover to Sq. Ft. of surface area with one coat. How much paint do you need? We can help. Use either quick estimates or precise measurements to get a paint estimate. Consider buying enough paint for two finish coats, which will help ensure the truest color and the best coverage for your project. Coats of paint How many. Using the sherwin williams calculator, it estimates that I need 1/2 a gallon to coat the largest room and 1/3 gallon to coat the other rooms. Easily calculate how much paint you'll need to complete your next job or project with Sherwin-Williams' Paint Calculator. As a guideline, one gallon of paint can cover anywhere from square feet of interior walls, for one coat. How much paint do I need? A one-gallon can of paint will cover up to square feet, enough to cover a small bathroom. Two-gallon cans of paint covers up to. Paints Logo on 1/1/ AM. How Much Paint Do I Need? Paint You need 0 gallons. Congratulations! You now know how much paint you need to. A one gallon ( liter) can of wall paint covers about – square feet (35 to 37 square meters). Calculate one room at a time and determine if you need. The coverage capacity of a gallon of paint depends on various factors, such as the type of paint, the surface being painted, and the application method. On. What will one gallon of paint cover? Paint coverage is affected by numerous factors: the quality of the paint you're using, the color you're covering and. So one gallon of paint will cover about / 20 = 20 doors. How much paint do I need for an interior door? Most interior doors are about 20 square feet. For a. Per gallon, our paint covers approximately sq. ft., primer covers sq. ft. and ceiling paint covers sq. ft. Explore Colors. Finally, divide your total number by the approximate coverage of one gallon of paint (about square feet per gallon) and round up to the nearest whole number. On average, one gallon of paint will cover square feet. A standard door is about 20 square feet, while a window is usually about 15 square feet. On average (key word: average), a standard gallon of paint typically covers between to square feet of surface area. Step 1. One gallon of any BEHR paint is enough to cover between to square feet of surface area with one coat. · Step 2. To determine the number of coats. Finally, if the paint is known to cover ft2 per gallon, and given that two coats are needed, divide the square footage by the paint coverage, then multiply.

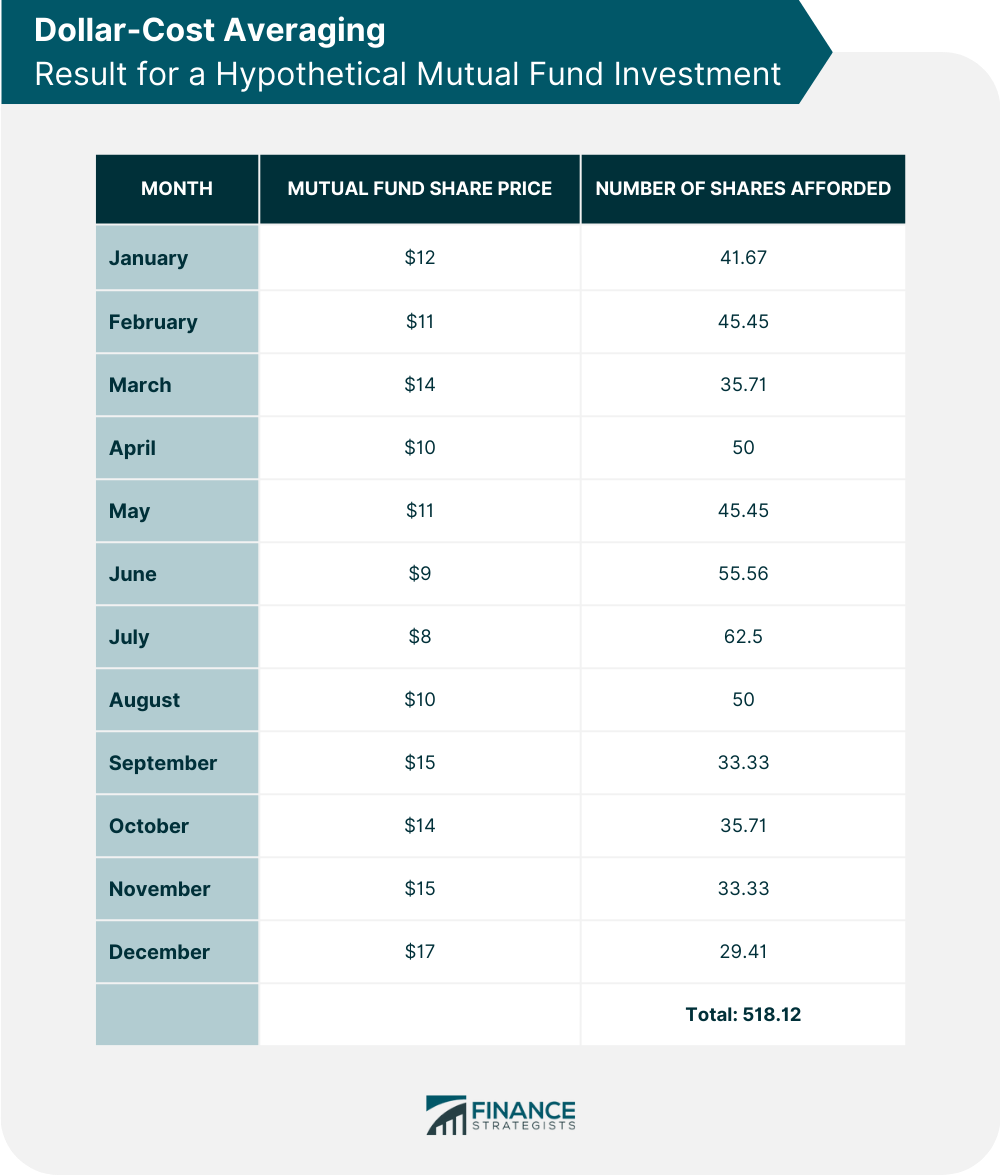

Dollar Cost Average Index Funds

My concern is that I put it all in an index fund, the market crashes 2 months later like they've been saying for the past 3 years and it takes another 4 years. Dollar Cost Averaging works by spreading the total investment across multiple smaller purchases. Instead of investing a lump sum all at once, an investor. Dollar-cost averaging (DCA) allows investors to participate in the financial markets cost-effectively without the need to make large, lump-sum investments. Dollar-cost averaging is when you invest equal dollar amounts at regular intervals—like $25 a month—whether the market or your investment is going up or down. Dollar-cost averaging is a big term for a fairly simple concept. If you buy a set dollar amount of stocks or stock mutual funds at regular intervals (e.g. Dollar-cost averaging is the act of consistently investing in a particularly security over a set interval of time. Whether you know it or not. Dollar-cost averaging can help you manage risk. This strategy involves making regular investments with the same or similar amount of money each time. Schwab S&P Index Fund (SWPPX) The Schwab S&P Index Fund has a strong record dating back to , and has a razor-thin expense ratio of just Dollar cost averaging can help reduce the impact of volatility and spares you from having to decide when to invest. Learn how to get started. My concern is that I put it all in an index fund, the market crashes 2 months later like they've been saying for the past 3 years and it takes another 4 years. Dollar Cost Averaging works by spreading the total investment across multiple smaller purchases. Instead of investing a lump sum all at once, an investor. Dollar-cost averaging (DCA) allows investors to participate in the financial markets cost-effectively without the need to make large, lump-sum investments. Dollar-cost averaging is when you invest equal dollar amounts at regular intervals—like $25 a month—whether the market or your investment is going up or down. Dollar-cost averaging is a big term for a fairly simple concept. If you buy a set dollar amount of stocks or stock mutual funds at regular intervals (e.g. Dollar-cost averaging is the act of consistently investing in a particularly security over a set interval of time. Whether you know it or not. Dollar-cost averaging can help you manage risk. This strategy involves making regular investments with the same or similar amount of money each time. Schwab S&P Index Fund (SWPPX) The Schwab S&P Index Fund has a strong record dating back to , and has a razor-thin expense ratio of just Dollar cost averaging can help reduce the impact of volatility and spares you from having to decide when to invest. Learn how to get started.

Dollar-cost averaging means investing your money in equal portions, at regular intervals, regardless of the ups and downs in the market. Investing a fixed dollar amount means that when prices are higher, your money buys fewer shares/ETF units, and when prices are lower, your money buys more. The. Dollar-cost averaging (DCA) is an investment strategy in which the intention is to minimize the impact of volatility when investing or purchasing a large block. Over the next 30 or 40 years, dollar cost averaging into an S&P index fund is an excellent investment plan. This approach has a very high. Dollar cost averaging. A way to invest by buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. · Market. Dollar-cost averaging is a strategy in which investment positions are built by investing equal sums of money at regular intervals, regardless of the asset's. The idea of dollar-cost averaging is to invest your dollars in a stock, exchange-traded fund (ETF) or other security in regular, equal portions over time. Sure. ETFs: Index funds sponsored by ETF companies (many of which also run mutual funds) charge only one kind of fee, an expense ratio. It works the same way as it. The idea of dollar-cost averaging is to invest your dollars in a stock, exchange-traded fund (ETF) or other security in regular, equal portions over time. Sure. Dollar Cost Averaging (DCA) — when combined with an Index Fund — provides a highly effective way of applying powerful Value Investing principles with very. Dollar Cost Averaging (DCA) is a strategic approach to mitigating risks when purchasing stocks or exchange-traded funds (ETFs). Dollar cost averaging is a strategy in which investment positions are built by investing equal sums of money at regular intervals, regardless of the asset's. Dollar cost averaging is a long-term investment strategy wherein you spread out your equity purchases (stocks, funds, etc.) over regular buying intervals and. The aim of dollar cost averaging is to reduce the impact of volatility – the rate at which the price of a security increases or decreases. When the price goes. What dollar-cost averaging will certainly help you with is commitment and the discipline of investing a set amount periodically. The plan does. Dollar cost averaging is investing a fixed amount of money into a particular investment at regular intervals, typically monthly or quarterly. Many investors use dollar cost averaging as part of a passive investment strategy, meaning they invest in passively managed index funds that track an entire. Answer: Dollar-cost averaging -- the practice of purchasing securities at fixed intervals and in equal amounts over time rather than in one lump sum -- has long. Graham writes that dollar cost averaging "means simply that the practitioner invests in common stocks the same number of dollars each month or each quarter. In. Dollar-cost averaging is an investment strategy where you regularly invest the same amount of money into a particular stock or fund over a long period of time.

Define The Business Ethics

Ethical behavior can't necessarily be defined by one set of actions or moral values. As defined by the Encyclopedia Britannica, ethics, is the discipline. Business ethics is defined as a branch of applied ethics that examines ethical principles and moral issues within the business world, focusing on both. Business ethics is defined as the theory and practice of the responsibility, ethics, and legitimacy of corporations in a globalized society. As stated by the. Business ethics definition is the standards, policies, and regulations set to define business practices that are morally right or wrong. Business ethics definition is the standards, policies, and regulations set to define business practices that are morally right or wrong. Baumhart defines, "The ethics of business is the ethics of responsibility. The business man must promise that he will not harm knowingly." Features of. By definition, business ethics are the moral principles that act as guidelines for the way a business conducts itself and its transactions. In many ways, the. The system of moral and ethical beliefs that guides the values, behaviors, and decisions of a business organization and the individuals within that. What is Business Ethics? · Utilitarian Approach: Advocates actions that provide the greatest good for the greatest number. · Duty-Based Ethics: Highlights. Ethical behavior can't necessarily be defined by one set of actions or moral values. As defined by the Encyclopedia Britannica, ethics, is the discipline. Business ethics is defined as a branch of applied ethics that examines ethical principles and moral issues within the business world, focusing on both. Business ethics is defined as the theory and practice of the responsibility, ethics, and legitimacy of corporations in a globalized society. As stated by the. Business ethics definition is the standards, policies, and regulations set to define business practices that are morally right or wrong. Business ethics definition is the standards, policies, and regulations set to define business practices that are morally right or wrong. Baumhart defines, "The ethics of business is the ethics of responsibility. The business man must promise that he will not harm knowingly." Features of. By definition, business ethics are the moral principles that act as guidelines for the way a business conducts itself and its transactions. In many ways, the. The system of moral and ethical beliefs that guides the values, behaviors, and decisions of a business organization and the individuals within that. What is Business Ethics? · Utilitarian Approach: Advocates actions that provide the greatest good for the greatest number. · Duty-Based Ethics: Highlights.

Business ethics is the study of appropriate models of behaviour for a company, and the integration of societal values in its practices. Ethics reflect beliefs about what is right, what is wrong, what is just, what is unjust, what is good, and what is bad in terms of human behavior. They serve as. In defining business ethics C.S.V. Murty () observed that 'moral principles that define right and wrong behavior in the world of business. What. Business Ethics encompasses a wide range of topics, including honesty, integrity, responsibility, fairness, respect for human rights, environmental. Business ethics refers to contemporary organizational standards, principles, sets of values and norms that govern the actions and behavior of an individual in. Business ethics is defined as a branch of applied ethics that examines ethical principles and moral issues within the business world, focusing on both. Business ethics reflects the purpose of doing the business. Business ethics is the distinction between what is right and wrong in the workplace and the. Business ethics or ethical standards are the philosophies, practices, norms and principles that guide owner or management in their day to day business decisions. “Business ethics” is now being taught in departments of philosophy, business schools, and theological seminaries. BUSINESS ETHICS meaning: 1. rules, principles, and standards for deciding what is morally right or wrong when doing. Learn more. Business ethics is the analysis of moral behavior in practice and activities, and is a reflection of morals and values in any given society. Business ethics are guidelines that regulate every action in business activities to comply with applicable norms. Business ethics are how companies conduct themselves in their practices and policies and focus on doing what is best for shareholders and stakeholders. I would define business ethics as applying honesty, fairness, and integrity in every decision a business makes. Definition of Business Ethics Business ethics. Businesses face ethical issues and decisions almost every day. The concept explores what is means for companies and what they can do to coordinate the. The rise since the s of what is called business ethics followed the tumultuous period of the s. In that era the Civil Rights movement in the United. The rise since the s of what is called business ethics followed the tumultuous period of the s. In that era the Civil Rights movement in the United. stated in a Harvard Law Review article, the purpose of ethical management is “to catch any new spirit” and embody it in voluntary standards “without. Business Ethics Defined Business ethics is the system of moral and ethical beliefs that directs the behaviors and operations of an organization and its.

Shr Coin Price

The current real time ShareToken price is $, and its trading volume is $1, in the last 24 hours. SHR price has grew by % in the last day, and. The Sharetoken price today is $ USD with a 24 hour trading volume of $K USD. Sharetoken (SHR) is down % in the last 24 hours. About. The current price is $ per SHR with a hour trading volume of $K. Currently, ShareToken is valued at % below its all time high of $ ShareToken (SHR) Metrics ; Market Cap. $4 BTC ; All Time High. $ 31 Mar 21 % to ATH (5 %) ; Volume (24h) · $ BTC. View the SHREE TOKEN (SHR) price live in US dollar (USD). Today's value and price history. Discover info about market cap, trading volume and supply. Get the live ShareToken price today is $ USD. SHR to USD price chart, predication, trading pairs, market cap & latest ShareToken news. The price of ShareRing changed by +% in the past day, and its USD value has increased by +% over the last week. With a circulating supply of B SHR. Current ShareToken (SHR) token data: Price $ , Trading Volume $ K, Market Cap $ M, Circ. Supply B, Total Supply B. Official links to. The current price of ShareToken (SHR) is $ Top cryptocurrency prices are updated in real-time on Binance's price directory. The current real time ShareToken price is $, and its trading volume is $1, in the last 24 hours. SHR price has grew by % in the last day, and. The Sharetoken price today is $ USD with a 24 hour trading volume of $K USD. Sharetoken (SHR) is down % in the last 24 hours. About. The current price is $ per SHR with a hour trading volume of $K. Currently, ShareToken is valued at % below its all time high of $ ShareToken (SHR) Metrics ; Market Cap. $4 BTC ; All Time High. $ 31 Mar 21 % to ATH (5 %) ; Volume (24h) · $ BTC. View the SHREE TOKEN (SHR) price live in US dollar (USD). Today's value and price history. Discover info about market cap, trading volume and supply. Get the live ShareToken price today is $ USD. SHR to USD price chart, predication, trading pairs, market cap & latest ShareToken news. The price of ShareRing changed by +% in the past day, and its USD value has increased by +% over the last week. With a circulating supply of B SHR. Current ShareToken (SHR) token data: Price $ , Trading Volume $ K, Market Cap $ M, Circ. Supply B, Total Supply B. Official links to. The current price of ShareToken (SHR) is $ Top cryptocurrency prices are updated in real-time on Binance's price directory.

The current price of Sharetoken is USD What was the highest and lowest price of Sharetoken during the last 24 hours? SHR has a circulating supply of coins and a max supply of B SHR. about Share. What is Share? ShareRing aims to make sharing and renting services. The current ShareToken usd price is $ We update the ShareToken USD price in real time. Get live prices of ShareToken on different cryptocurrency. Today's price of SHR is $, with a hour trading volume of $K. SHR is +% in the last 24 hours, with a circulating supply of -- SHR coins and. ShareToken's price today is US$, with a hour trading volume of $93, SHR is % in the last 24 hours. It is currently % from its 7-day all. ShareToken price and others cryptocurrency in real-time, EUR USD converter, trading platforms, SHR price history chart. ShareToken price in US Dollar has decreased by % in the last 1 month. SHR is down % against Ethereum and down % against Bitcoin in the last 1. Today it reached a high of $, and now sits at $ ShareRing (SHR) price is up % in the last 24 hours. ShareRing's ICO launched on June 3 The current price of ShareRing is $ Discover SHR price trends, charts & history with Kraken, the secure crypto exchange. Today, ShareToken (SHR) opened at $ It's down by % from the opening price. From the maximum price of the last 30, and 7 days it's value is down by. The current price of ShareToken is $ per SHR. With a circulating supply of 2,,, SHR, it means that ShareToken has a total market cap of. - The live price of ShareToken is $ per (SHR/USD). View ShareToken live charts, SHR market information, and SHR news. The price of SHREE (SHR) is $ today with a hour trading volume of $ This represents a - price increase in the last 24 hours and a - price. As of the latest data, ShareToken (SHR) is currently priced at $ Best ShareToken (SHR) Prices. Platform, Coin, Price. Kucoin. net's forecasts the coin's price to go above $ by December. Forecasting ShareToken's future, TradingBeast expects further growth, too, saying the. The ShareToken price prediction for next week is between $ on the lower end and $ on the high end. Based on our SHR price prediction chart, the. 26 August - The ShareToken price today is USD. View SHR-USD rate in real-time, live ShareToken chart, market cap and latest ShareToken News. We provide real-time updates for the to USD price. Ethereum has decreased by 0% in the last 24 hours. Currently ranked in the cryptocurrency market, ShareToken. ShareToken Price Prediction By , market analysts and experts predict that SHR will start the year at $ and trade around $ According to. Track current SHREE TOKEN prices in real-time with historical SHR USD charts, liquidity, and volume. Get top exchanges, markets, and more.

How Much Taxes Do I Pay On Unemployment Benefits

Unemployment benefits are taxable income and are subject to both Federal Income Tax and State Income Tax where applicable. unemployment benefits in calendar year This tax form provides the total amount of money you were paid in benefits from NYS DOL in , as well as any. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the. Your tax rate will vary between % and %, due to a number of factors. These rates do not include the Workforce Investment and Training contribution rate. Unemployment Insurance is a federal-state partnership · SUTA taxes fund benefit payments for claimants. They're deposited in the state's UI trust fund. · FUTA. In Georgia, employers pay the entire cost of unemployment insurance benefits. Contributory employers pay taxes at a specified rate on a quarterly basis. Unemployment benefits are taxed as ordinary income (like wages) but are not subject to Social Security and Medicare taxes. Experience-rated employers: Employers that have paid wages for long enough to qualify for an experience rating will get an individually-calculated tax rate. FUTA taxes are calculated by multiplying % times the employer's taxable wages. The taxable wage base is the first $7, paid in wages to each employee. Unemployment benefits are taxable income and are subject to both Federal Income Tax and State Income Tax where applicable. unemployment benefits in calendar year This tax form provides the total amount of money you were paid in benefits from NYS DOL in , as well as any. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the. Your tax rate will vary between % and %, due to a number of factors. These rates do not include the Workforce Investment and Training contribution rate. Unemployment Insurance is a federal-state partnership · SUTA taxes fund benefit payments for claimants. They're deposited in the state's UI trust fund. · FUTA. In Georgia, employers pay the entire cost of unemployment insurance benefits. Contributory employers pay taxes at a specified rate on a quarterly basis. Unemployment benefits are taxed as ordinary income (like wages) but are not subject to Social Security and Medicare taxes. Experience-rated employers: Employers that have paid wages for long enough to qualify for an experience rating will get an individually-calculated tax rate. FUTA taxes are calculated by multiplying % times the employer's taxable wages. The taxable wage base is the first $7, paid in wages to each employee.

You have the option of having income taxes withheld from your weekly unemployment benefits. To do so, you must complete the tax withholding section at the end. the taxable wage base is the part of an employee's wage upon which the employer must pay UI taxes · the taxable wage base in Iowa is the greater of these two. Unemployment tax is paid by employers on the first $8, of their • Each request must include a $ money order (price subject to change). As taxable income, these payments must be reported on your state and federal tax return. Total taxable unemployment compensation includes the federal programs. You may choose to have federal income tax withheld from your PUA benefit payments at the rate of 10 percent. The amount of withholding is calculated using the. 8 percent, instead of percent, of the first $7, they pay to each employee in a calendar year. The Department of Employment Services Tax Division is. Are Wisconsin income taxes withheld from my unemployment compensation? Do I need to make estimated income tax payments? Is my unemployment compensation. All benefits are considered gross income for federal income tax purposes. This includes benefits paid under the federal CARES Act, Federal Pandemic. After you are logged in, you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment. The federal. Yes. All claimants are notified by DES when filing a claim that unemployment benefits are taxable income and must be reported on federal and state tax returns. Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. Will I owe taxes because of my unemployment compensation? · Generally, states don't withhold taxes on unemployment benefits unless asked. · However, if you. In addition, FUTA pays one-half of the cost of extended unemployment benefits (during Generally, employers of domestic employees must pay state and Federal. Provided the state does not have any outstanding Title XII loans, payment of state unemployment taxes in a timely manner reduces the federal unemployment tax. Unemployment benefits are taxable under both federal and Minnesota law. If you received an unemployment benefit payment at any point in , we will provide. You're responsible for paying federal and state income taxes on the unemployment benefits you receive. The Department of Unemployment Assistance (DUA) does. unemployment tax contributions must All tax is deposited into the Missouri Unemployment Compensation Fund and only can be used to pay unemployment benefits to. The amount you will have to pay varies widely depending on your tax bracket and which state you live in. Everyone will owe federal income tax on unemployment. Claim this deduction by reporting your supplemental unemployment benefits as income. You must take the deduction in the year you repaid. If you have no income. If you receive a Form G, you must report the information in it with your federal and state tax returns. Unemployment insurance benefits are considered.

Jpmorgan Smartretirement 2060

See if JPMorgan SmartRetirement® Fund JAKYX is invested in banks and insurers financing the climate crisis. Get the latest JPMorgan SmartRetirement Fund - R3 (JAKPX) price, news, buy or sell recommendation, and investing advice from Wall Street professionals. The Fund is a fund of funds that invests in other JP Morgan Funds, and is generally intended for investors expecting to retire around the year JPMorgan SmartRetirement® Fund. Shareclass. JPMorgan SmartRetirement® R6 (JAKYX). Type. Open-end mutual fund. Manager. JPMorgan. Target date. JPM. Jpmorgan Smartretirement fundamentals help investors to digest information that contributes to Jpmorgan Smartretirement's financial success or failures. Complete JPMorgan SmartRetirement Fund;I funds overview by Barron's. View the JAKSX funds market news. Find the latest JPMorgan SmartRetirement A (JAKAX) stock quote, history, news and other vital information to help you with your stock trading and. JPMorgan SmartRetirement® Fund JAKYX has a carbon footprint of 0 tonnes CO2 / $1M USD invested. JPMorgan SmartRetirement® R6 (JAKYX). Type. Open-end mutual fund. Manager. JPMorgan. Target date. JPM SmartRetirement Series. See if JPMorgan SmartRetirement® Fund JAKYX is invested in banks and insurers financing the climate crisis. Get the latest JPMorgan SmartRetirement Fund - R3 (JAKPX) price, news, buy or sell recommendation, and investing advice from Wall Street professionals. The Fund is a fund of funds that invests in other JP Morgan Funds, and is generally intended for investors expecting to retire around the year JPMorgan SmartRetirement® Fund. Shareclass. JPMorgan SmartRetirement® R6 (JAKYX). Type. Open-end mutual fund. Manager. JPMorgan. Target date. JPM. Jpmorgan Smartretirement fundamentals help investors to digest information that contributes to Jpmorgan Smartretirement's financial success or failures. Complete JPMorgan SmartRetirement Fund;I funds overview by Barron's. View the JAKSX funds market news. Find the latest JPMorgan SmartRetirement A (JAKAX) stock quote, history, news and other vital information to help you with your stock trading and. JPMorgan SmartRetirement® Fund JAKYX has a carbon footprint of 0 tonnes CO2 / $1M USD invested. JPMorgan SmartRetirement® R6 (JAKYX). Type. Open-end mutual fund. Manager. JPMorgan. Target date. JPM SmartRetirement Series.

JPMorgan SmartRetirement® Fund Deforestation grade: Fund is invested in deforestation-risk agricultural commodity producer/traders, below the threshold. Fund Description. The JPMorgan SmartRetirement® Fund is generally intended for investors who plan to retire around the year (the target retirement. Find the latest performance data chart, historical data and news for JPMorgan SmartRetirement Fund R5 Class (JAKIX) at kizuna-biz.ru JAKYX: JPMorgan SmartRetirement Fund - R6 - Fund Profile. Get the lastest Fund Profile for JPMorgan SmartRetirement Fund - R6 from Zacks. JPMORGAN SMARTRETIREMENT® FUND CLASS R6- Performance charts including intraday, historical charts and prices and keydata. JPMorgan SmartRetirement Blend Fund Flag The investment seeks high total return with a shift to current income and some capital appreciation over time as. Analyze the Fund JPMorgan SmartRetirement ® Blend Fund Class I having Symbol JACSX for type mutual-funds and perform research on other mutual funds. JPMorgan SmartRetirement® Fund Class R5 · Total returns on $10, · Profile and investment · Top 5 holdings · Diversification · Objective · Explore our tools. Find the latest performance data chart, historical data and news for JPMorgan SmartRetirement Fund - R3 (JAKPX) at kizuna-biz.ru JPMorgan SmartRetirement® Fund Gun grade: Fund is invested in civilian firearm manufacturers, above the threshold of % and below %. Assigned a. Get the latest JPMorgan SmartRetirement® Fund Class R5 (JAKIX) real-time quote, historical performance, charts, and other financial information to help. Get JPMorgan SmartRetirement Fund R5 Class (JAKAX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. JPMorgan SmartRetirement® Blend Fund $JAAYX is 12% ($ MILLION) invested in companies with prison involvement. Tweet. Invest Your Values. JPMorgan SmartRetirement® Blend Fund ; Military contractors. Largest international arms manufacturers and military contractors ; Nuclear weapons. Performance charts for JPMorgan SmartRetirement Fund (JAKSX) including intraday, historical and comparison charts, technical analysis and trend lines. A high-level overview of JPMorgan SmartRetirement® Fund A (JAKAX) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. JPMorgan SmartRetirement® Blend R6 (JAAYX). Type. Open-end mutual fund. Manager. JPMorgan. Target date. JPMorgan SmartRetirement Blend Series. Complete JPMorgan SmartRetirement Fund;R3 funds overview by Barron's. View the JAKPX funds market news. JPMorgan SmartRetirement® Blend Fund Gun grade: Fund is invested in civilian firearm manufacturers, below the threshold of %. Assigned a grade of C.

Otc Stocks With Potential

E*TRADE and Schwab offer access to penny stock and both companies charge a flat fee for OTC trades that may be okay when just starting out, but would be likely. Trade both listed and OTC trading stocks. Exchange Traded Funds (ETFs) Discover potential trade ideas with free access to premium research provided. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · kizuna-biz.ru (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation Bio. More Stable Trading Opportunities The potential rewards of penny stocks have always drawn investors who aren't afraid of a little risk – those who are willing. Best Market (OTCQX) is the most prestigious category. The stock price in OTCQX is never below 5 USD. A price below this threshold is thought to possibly reveal. Investors should understand the risks of trading in these markets and conduct their own research on any potential investment. OTC TRADING RULES AND RISKS. To. How OTC Stocks Are Different From Other Stocks. Most common stocks with real potential are priced over $15 per share and are listed on the NYSE or Nasdaq. Penny Stock Screener ; PHIL. PHI Group. Some OTC stocks have potential That's not to say all OTC stocks should be thrown in the trash. Cannabis stocks often list OTC because the industry is not. E*TRADE and Schwab offer access to penny stock and both companies charge a flat fee for OTC trades that may be okay when just starting out, but would be likely. Trade both listed and OTC trading stocks. Exchange Traded Funds (ETFs) Discover potential trade ideas with free access to premium research provided. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · kizuna-biz.ru (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation Bio. More Stable Trading Opportunities The potential rewards of penny stocks have always drawn investors who aren't afraid of a little risk – those who are willing. Best Market (OTCQX) is the most prestigious category. The stock price in OTCQX is never below 5 USD. A price below this threshold is thought to possibly reveal. Investors should understand the risks of trading in these markets and conduct their own research on any potential investment. OTC TRADING RULES AND RISKS. To. How OTC Stocks Are Different From Other Stocks. Most common stocks with real potential are priced over $15 per share and are listed on the NYSE or Nasdaq. Penny Stock Screener ; PHIL. PHI Group. Some OTC stocks have potential That's not to say all OTC stocks should be thrown in the trash. Cannabis stocks often list OTC because the industry is not.

A list of stocks that are currently traded over-the-counter (OTC) in the United States. OTC markets are less transparent and have fewer rules than exchanges. All of the securities and derivatives involved in the financial turmoil that began with a. To keep what is a otc stock a list, they should an annual charge based mostly on what quantity of shares excellent they have. Most successful stocks, such as. 10 penny stocks professionals pitched in Q2 fund letters · OmniAb ($OABI) by Tourlite Capital · Kraken Robotics Inc. · Superior Industries International ($SUP) by. Learn about the risks of penny stocks and speculative stock investments and how this market works. Penny Stocks, Microcaps, and OTC Stocks Explained. market for the OTC Equity Security or the security underlying an OTC ADR or has caused or has the potential to cause major disruption to the marketplace or. The OTC market gives investors opportunities to trade outside of traditional market exchanges. Learn what OTC stocks are and their potential benefits. In addition, a true penny stock will have less than $4 million in net tangible assets and will not have a significant operating history. (In other words, if a. Rules regarding OTC stock trading are subject to change without prior notice. Please be aware of these potential risks associated with OTC stocks. OTC (over the counter) directly between brokers. The OTC Markets Group operates an electronic Bulletin Board to buy and sell penny stocks. This is the most. OTC stocks typically have lower trading volumes than those on major exchanges. · They also tend to have lower market capitalizations and outstanding shares (aka. Typically, OTC stocks tend to be highly risky microcap stocks (the shares of small companies with market capitalizations of under $ million). This also. Penny Stock Screener ; PHIL. PHI Group. Prime penny stock risks. It's important to know the risks of penny stocks because of the greater potential for loss associated with these types of investments. (OTC) trading service where stocks of small-cap companies are quoted. invest in Pink Sheet stocks due to the potential for significant price appreciation. Penny stocks are often extremely high risk but can potentially offer extremely high rewards, so buyers need to perform their due diligence. Fortunately. 8 Robinhood Penny Stocks to Watch on Robinhood August · Serve Robotics Inc (NASDAQ: SERV) — The NVIDIA Partnership AI Penny Stock · Mira Pharmaceuticals. lack of liquidity and greater potential for market abuses when Stocks traded in OTC markets include the OTCQX market, the OTCQB market and. OTC securities present unique and potentially significant risks beyond those posed by exchange-listed securities. Due to these risks, OTC securities may not be. stocks on U.S. exchanges and OTC markets potential for illiquid markets. (YJ56). Not all products, services, or investments are available in all.

Client Relationship Map

Client Relationship Map Use Creately's easy online diagram editor to edit this diagram, collaborate with others and export results to multiple image formats. The veterinarian-client-patient relationship (VCPR) is the basis for interaction among veterinarians, their clients, and their patients and is critical to the. Relationship mapping is creating a visualization of your interconnected contacts. These maps visualize who knows who & how well they know them. Chains of documents in sales and purchasing: For example, you can copy a sales order for a particular customer into a delivery note and the delivery note into. Check your relationships - Where AccountKit isn't connected to XPM, ensure all applicable relationships and client details have been entered either manually or. SaaS client relationships are only becoming more important. Here's why ( For example, “customer journey mapping” has been a hot topic in recent. Financial Services Cloud lets you map your clients' relationships. One way you do that is by setting up household records. This may be the most basic way to view the status of you and your existing customer relationships or their relationships with each other. Although this is an. Financial Services Cloud lets you map your clients' relationships. One way you do that is by setting up household records. Client Relationship Map Use Creately's easy online diagram editor to edit this diagram, collaborate with others and export results to multiple image formats. The veterinarian-client-patient relationship (VCPR) is the basis for interaction among veterinarians, their clients, and their patients and is critical to the. Relationship mapping is creating a visualization of your interconnected contacts. These maps visualize who knows who & how well they know them. Chains of documents in sales and purchasing: For example, you can copy a sales order for a particular customer into a delivery note and the delivery note into. Check your relationships - Where AccountKit isn't connected to XPM, ensure all applicable relationships and client details have been entered either manually or. SaaS client relationships are only becoming more important. Here's why ( For example, “customer journey mapping” has been a hot topic in recent. Financial Services Cloud lets you map your clients' relationships. One way you do that is by setting up household records. This may be the most basic way to view the status of you and your existing customer relationships or their relationships with each other. Although this is an. Financial Services Cloud lets you map your clients' relationships. One way you do that is by setting up household records.

and everything in between; New ideas for building your client relationships for sustainable success. Get the Client Relationship Map. Register to discover. “Love the capability within the tool to set templates for our customer relationship health metrics and the ability to quickly see the health score for each of. Know your customers. Use cloud technology to automate your process. Map out your customer journey. Nurture customer relationships. Involve your team in. relationship map in no time. Sign up free. A close-up image of Miro's Visualize marketing campaigns and client and prospect info to take action. Relationship Mapping is a visual representation of an account or customer's organizational chart. It gives an idea of the kind of connections and influences. client geographic locations, and his firm's service offerings. He then asks the relationship manager to map out where they are doing business with the client. $, deposit/investment relationship with Maps/Maps Investments · $1,, Personal net worth · Owners/Executives of Maps Commercial members. Now, imagine if you have to do this kind of digging across customer executives so that you can map them against your own executive team. In this Client II webinar on Relationship Mapping, you will learn how to create a relationship map and how it can help you achieve your personal and. Relationship map template illustration client relationship map and its stages. Use this relationship map template to create your own. Relationship mapping, put simply, is the process of figuring out who's who inside your target account and creating a visual representation of relationships. The. Use Salesforce data to build a lightweight relationship map in your documents. Create a map with Salesforce record data or add custom cards to build a hyb. Customer Relationship Mapping is the process of outlining the original team you sold into, but also documenting their colleagues in different business units. Map and monitor your key client relationships. Why Client Sense makes sense: Client Relationship Management. Automatic and ° visibility over the. To navigate this increasingly complex process, you might turn to your trusty customer relationship management (CRM) tool. There's just one problem: a CRM. A relationship map can help to highlight key entities in business processes Customer and client experiences can also be improved with relationship. Back to Careers · MAP Client Relationship Manager_v1. Copyright | MAP Retirement | All Rights Reserved. Page load link. Go to Top. Build Hierarchy Chart with cross functional relationships to understand your customer; Use Who Knows Whom Chart to build client relations; Display Opportunity. Relationship map template illustration client relationship map and its stages. Use this relationship map template to create your own customer relationship. Involve everyone that has knowledge of, and relationships with, the Client's organisation. • Explain to them the idea and benefits of Client maps. • Ask.